UK Energy Market Update: As we move further into autumn, fluctuations in wholesale gas and power markets are affecting energy pricing and procurement strategies across the UK. This week’s insights cover the latest trends, market drivers, and potential implications for businesses.

Wholesale Gas Market Update

The UK wholesale gas market saw a bearish trend this week due to revised temperature forecasts for November and December. With milder-than-expected conditions anticipated, heating demand is set to decrease, thereby reducing the need for significant gas storage withdrawals. This may also impact gas injections for 2025, limiting demand in the coming months. Additionally, recent tensions in the Middle East, including Israel’s restrained response to Iranian missile strikes, have eased immediate concerns about significant supply disruptions from the region.

On the bullish side, the announcement by Total Energies of delays in new LNG facilities—originally scheduled for 2025—means the next major wave of LNG supply won’t come online until 2027. Meanwhile, ongoing conflicts involving Iran and Hezbollah remain a potential source of volatility, signaling potential future supply risks.

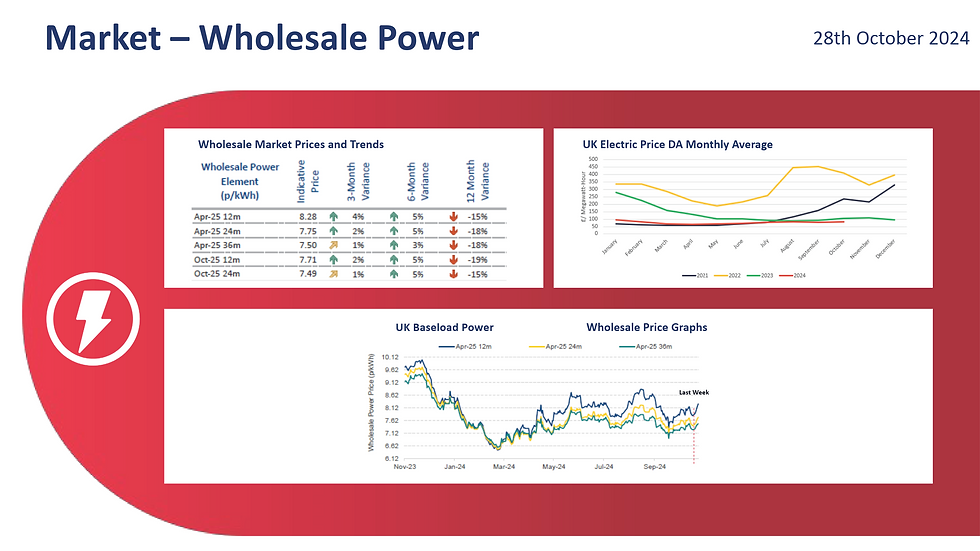

Wholesale Power Market Overview

In the UK power market, several bearish factors are helping keep prices stable. The upcoming launch of a 500MW Britain-Ireland interconnector in December is set to increase connectivity, while the Viking Link is expected to expand from 800MW to 1.2GW in the first half of 2025. These developments, alongside a substantial £24 billion investment in renewable energy generation and grid upgrades by private investors, are positioning the UK for a more resilient and sustainable power supply.

Conversely, bullish pressures stem from the environmental impact of the UK’s waste incinerators, which are currently as polluting as coal-fired power plants and make up around 3% of national generation. If the UK Emissions Trading Scheme (ETS) expands to cover waste incineration, it could drive up carbon prices, indirectly supporting fossil-fuel generation. Additionally, Europe’s ongoing trend of negative intraday power prices could pose a challenge for renewable developers, potentially impacting future investment in green energy if consistent revenue becomes uncertain.

What Does This Mean for Your Business?

These evolving trends in gas and power markets have implications for businesses planning their energy strategies. As warmer forecasts reduce near-term heating needs, gas prices may see relative stability; however, potential long-term supply delays and geopolitical risks remain factors to watch. For businesses relying on power, increased interconnection and renewable investments are positive signs, though upcoming regulatory changes in carbon pricing could impact the costs of traditional generation sources.

Stay Ahead with National Business Energy

Keeping up with market changes is essential for businesses aiming to optimise their energy use and costs. National Business Energy provides insights and expert guidance to help clients navigate these shifts effectively. Stay tuned for more updates and visit National Business Energy to learn how we can support your business’s energy efficiency goals in a dynamic market.

Comments