In this week's UK energy market update, developments in the global energy market have introduced new dynamics affecting wholesale gas and power prices in the UK. Here’s a breakdown of the key trends, drivers, and what they mean for businesses.

Wholesale Gas Market Update

The UK gas market continues to see a mix of bearish and bullish pressures.

On the bearish side, EU initiatives to reduce dependency on Russian LNG are gaining momentum. The European Commission President, Ursula von der Leyen, has supported increasing LNG imports from the US, addressing trade concerns while diversifying supply sources. Additionally, discussions between President Biden and the EU to align methane regulations aim to streamline LNG trade, potentially lowering costs and ensuring compliance with EU carbon regulations.

Conversely, bullish factors include Germany’s recent rejection of a Russian LNG cargo, which underscores Europe’s move away from Russian energy supplies but raises concerns about supply gaps. Early storage withdrawals in the UK and Europe, coupled with anticipated competition between Europe and Asia for LNG in summer 2025, are further supporting gas prices.

On the bullish side, geopolitical risks continue to pose potential supply concerns. Middle Eastern tensions escalated as Iran vowed an “unimaginable” response to recent Israeli actions, heightening fears of a broader regional conflict. Reports of a halted deal with Azerbaijan to replace Russian gas flows via Ukraine have also kept supply uncertainties on the radar.

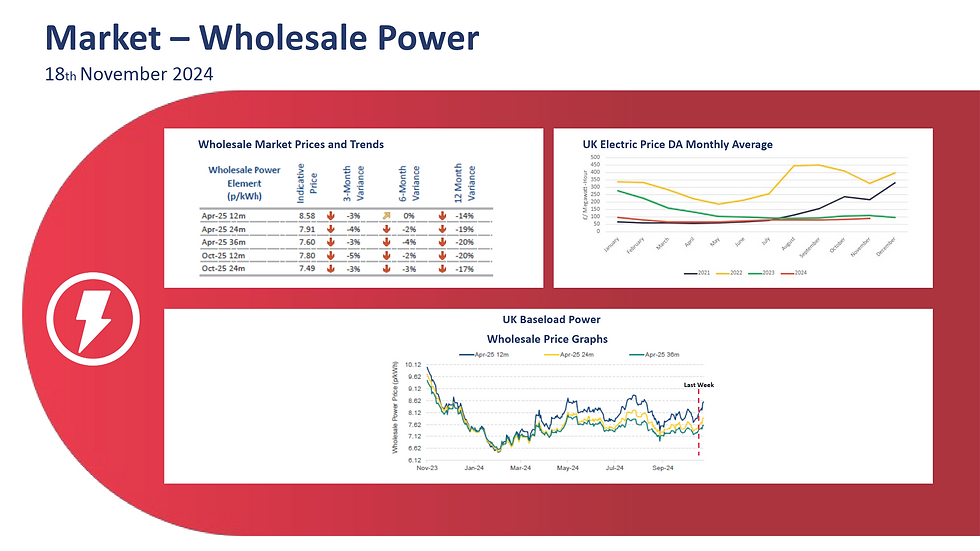

Wholesale Power Market Overview

The UK power market reflects a similarly complex outlook, with bearish signals arising from increased nuclear output in France. French power exports are expected to reach a 20-year high this winter, ensuring stable import prospects for the UK. Meanwhile, the UK renewable energy sector continues to flourish, with its value forecasted to grow by 60% by 2035, stimulating further investment and supporting long-term sustainability goals.

On the bullish side, geopolitical disruptions such as attacks on Ukraine’s power infrastructure have tightened the European supply-demand balance, potentially limiting imports to the UK. Additionally, European power demand is projected to rise by 2-3% annually between 2025 and 2030, driven largely by increased adoption of electric vehicles (EVs) and growth in the digital sector, which could strain the grid further.

What Does This Mean for Your Business?

These developments highlight the need for businesses to remain agile in their energy strategies. The ongoing diversification of gas supplies in Europe and growing renewable energy investments in the UK present opportunities for cost savings and sustainability. However, potential supply constraints and rising demand driven by EVs and data centers could introduce upward pressure on prices, requiring proactive management.

Stay Informed with National Business Energy

At National Business Energy, we stay ahead of market changes to ensure our clients benefit from tailored energy procurement strategies that save costs and enhance sustainability. Whether you’re seeking to optimise energy usage, explore renewable options, or manage risks in a volatile market, we’re here to help.

Discover how we can support your business by visiting National Business Energy. Let’s navigate these changes together and build a greener, more efficient future.

Comments